OJK’s Financial Conglomerate Framework: Preparing for the June Deadline

Indonesia has issued a new regulation on financial conglomerates that significantly reshapes how business groups in the financial sector must structure and report their operations. This update is particularly relevant for foreign investors, private banks, and digital finance platforms ahead of the June 2025 compliance deadline.

To implement Law No. 4 of 2023 on the Development and Strengthening of the Financial Sector (“Law 4/2023”), Indonesia’s Financial Services Authority (OJK) issued Regulation No. 30 of 2024 on Financial Conglomerates and Financial Conglomerate Holding Companies (“Regulation”) in December 2024. This Regulation replaces OJK Regulation No. 45/POJK.03/2020 (“OJK Reg. 45/2020”).

The new framework aims to enhance the efficiency and effectiveness of OJK’s supervision over financial services institutions (Lembaga Jasa Keuangan or LJKs) that are interconnected by ownership and/or control within a business group.

What Constitutes a Financial Conglomerate?

Under the Regulation, a financial conglomerate consists of:

a Financial Holding Company (Perusahaan Induk Konglomerasi Keuangan or PIKK), and

LJK members that fall within the same ownership or control group.

The PIKK serves as the controlling and consolidating entity. Its members may include a wide range of LJKs operating under conventional or Sharia principles, such as:

Banks

Insurance companies

Securities companies

Finance companies

Infrastructure finance companies

Guarantor agencies

Pension funds

Venture capital firms

Pawnbrokers

IT-based joint funding platforms

Crowdfunding operators

Other types of LJKs, excluding microfinance institutions.

Compared to OJK Reg. 45/2020, the new Regulation significantly broadens the definition of LJKs that qualify as conglomerate members.

Operational vs Non-Operational PIKK

A financial holding company (PIKK) that also holds a license to operate as a financial institution (LJK) is classified as an operational PIKK. In contrast, a holding company that does not carry out any financial services activities and is used solely as a holding and consolidation vehicle is classified as a non-operational PIKK.

Each PIKK, operational or non-operational, must be controlled directly by a Controlling Shareholder (Pemegang Saham Pengendali or PSP) and/or indirectly by an Ultimate Shareholder (Pemegang Saham Pengendali Terakhir or PSPT).

When Is a PIKK Required?

A PIKK must be established if a financial group’s total assets meet one of the following thresholds:

≥ IDR 100 trillion, with at least two LJKs from different financial sectors; or

IDR 20 trillion to < IDR 100 trillion, with at least three LJKs from different financial sectors.

Note: Asset thresholds are assessed based on the total assets of all LJK members over six consecutive months.

Groups approaching the IDR 20 trillion threshold should assess their current structure early to avoid rushed or reactive compliance.

OJK also retains discretionary authority to require the formation of a PIKK even if these thresholds are not met, where a group’s complexity or systemic relevance warrants it.

Relaxation and Exemption for Financial Conglomerate

The government provides incentives to support the formation of financial holding companies. Under Law Number 4 of 2023, companies that restructure their group by setting up a holding company may be eligible for tax benefits, especially for related asset transfers—provided they follow applicable tax rules.

In addition, the regulation waives key capital market obligations, including the requirement to conduct a mandatory tender offer, for share transfers made solely to comply with the holding company formation.

However, the tax incentives remain inactive pending issuance of implementing rules by the Minister of Finance.

Market Entry Path for Foreign Financial Holding Companies

Indonesia remains an attractive destination for foreign investors—many of whom operate as large, cross-border financial holding companies. However, Indonesia’s regulatory framework imposes clear limits on how these foreign entities can structure their investments.

Under the new regulation, a financial holding company must be incorporated in Indonesia and must receive approval from the Financial Services Authority (OJK). This means a foreign holding company cannot directly act as the central holding company (PIKK) to consolidate its local group members.

Instead, foreign investors must take an indirect control approach—by acting as the controlling shareholder (either directly or ultimately) of a locally incorporated PIKK. This PIKK then holds and manages the group’s financial services subsidiaries in Indonesia.

It is also important to note that full foreign ownership of a PIKK is not permitted. A minimum level of Indonesian ownership is required, reinforcing the regulator’s policy to maintain local control at the top of the structure.

|

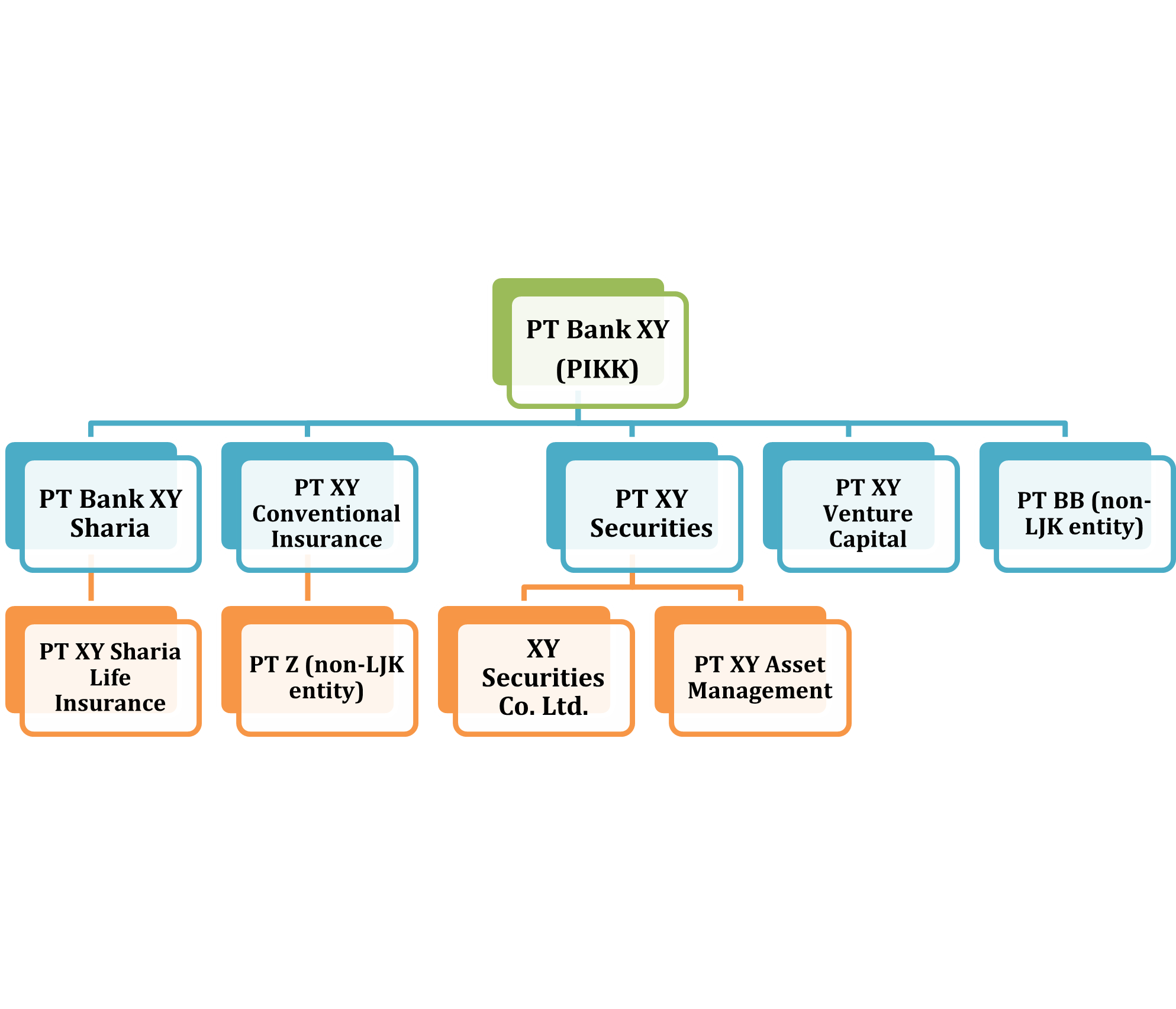

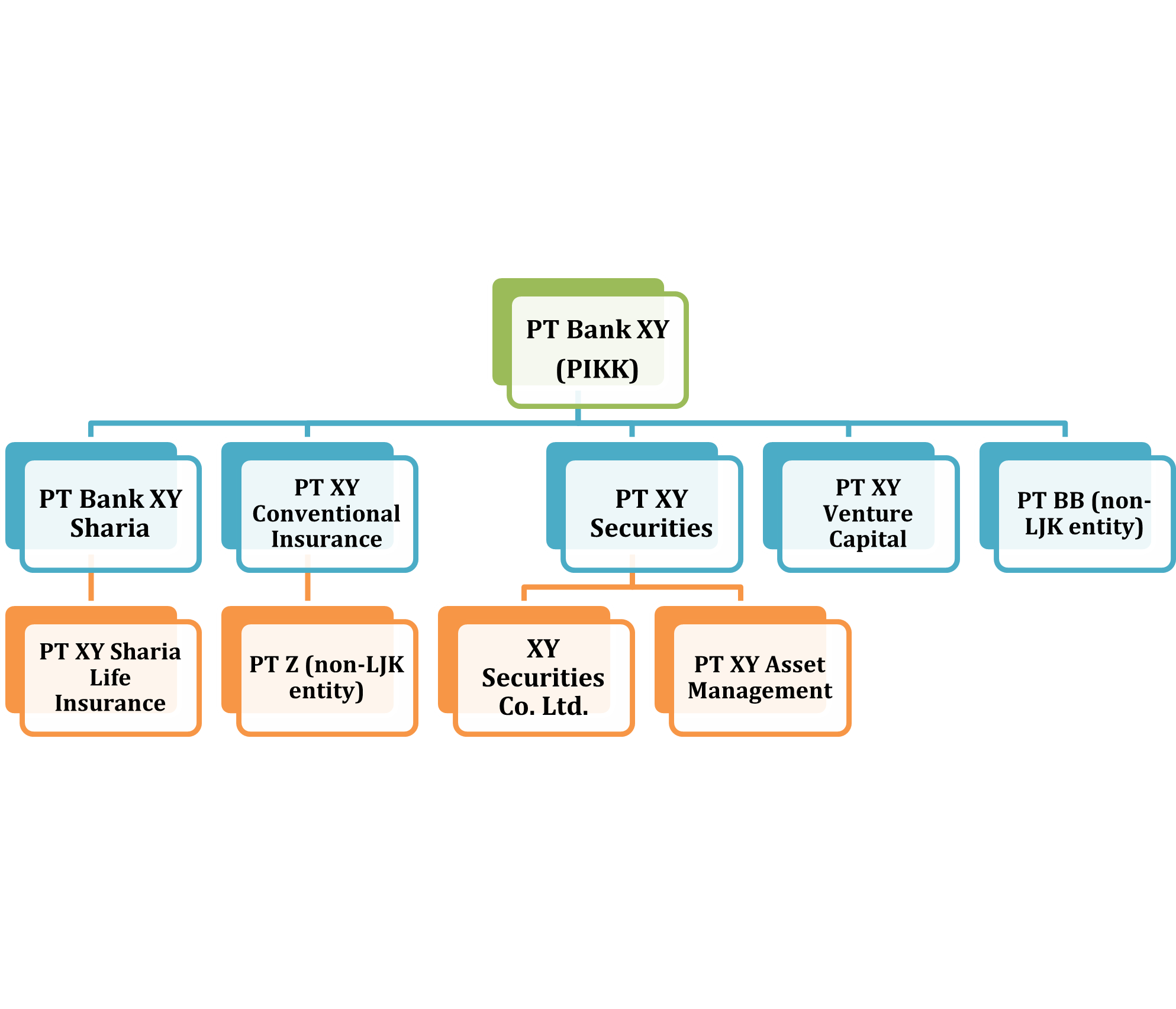

Illustration of a Financial Conglomerate Organization |

Foreign Ownership Limits: Operational vs Non-Operational Holding Companies

For operational holding companies—those licensed to conduct financial activities—the level of permitted foreign ownership is subject to sector-specific limits. For example:

Up to 85% foreign ownership is allowed in finance companies

Up to 80% for privately owned insurance companies

In some cases, these limits must be calculated on a cumulative basis, taking into account both direct and indirect ownership all the way up to the ultimate shareholder. This layered approach affects not only the holding company but also its subsidiaries within the group.

Key Operational Challenges for Foreign Holding Companies

Foreign investors that set up an operational financial holding company in Indonesia face several practical hurdles—particularly in complying with financial reporting and investment restrictions.

One major challenge is the requirement to consolidate financial statements. If the holding company is operational (for example, a licensed bank), it must combine its financial reports with those of its subsidiaries. This often becomes complicated when the group includes diverse businesses (e.g., insurance, financing, securities), each potentially governed by a different direct controlling shareholder, despite having the same ultimate shareholder. This may conflict with home-jurisdiction accounting standards and complicate group-level reporting.

A second challenge is that operational holding companies (PIKK) must also navigate sector-specific restrictions, which often conflict with the Regulation’s consolidation requirements—especially for foreign-controlled groups. For example, if a peer-to-peer (P2P) lending company is designated as the holding company, it faces two key limits:

A cap of 20% of total equity for all direct investments; and

A stricter 10% cap for investments in affiliated entities within the same group.

These caps may hinder effective group control and require alternative structuring strategies, especially for conglomerates seeking to consolidate via direct equity participation.

Indonesia’s Financial Conglomerates: State-Owned Dominance and Digital Momentum

Indonesia’s financial conglomerate landscape remains heavily dominated by state-owned banks, which hold the largest market share. Notably, these state-controlled institutions are exempt from several key provisions under the new regulation, placing the regulatory burden primarily on privately owned banks.

These private institutions often serve as financial holding companies, overseeing a diverse range of subsidiaries across financing, insurance, and capital markets. A notable trend is the growing integration of digital banks into these conglomerate structures, reflecting a broader shift toward digital transformation within Indonesia’s financial sector. The inclusion of IT-based platforms and crowdfunding operators in the definition of LJKs reflects OJK’s recognition of digital banking as a key player in future financial conglomerates.

Despite changes in the regulatory landscape, reporting obligations under OJK Regulation No. 18/POJK.03/2014—on integrated governance for financial conglomerates—remain in force. Although partially revoked by the previous regulation, it has not been repealed by the current framework. As such, newly established holding companies must still publish integrated governance reports on their official websites. These disclosures offer prospective investors valuable visibility into the group’s structure and governance practices.

Conclusion

Indonesia’s regulatory framework for financial conglomerates remains complex and strongly protectionist. This is reflected in both quantitative restrictions (such as ownership limits) and qualitative measures (such as structural control requirements), which pose significant barriers for foreign investors entering or expanding in the market.

Although the criteria for establishing a financial holding company (PIKK) are clearly defined, the Financial Services Authority (OJK) retains discretionary power to require the formation of a PIKK based on the group’s complexity or its potential impact on financial system stability.

With the 23 June 2025 submission deadline approaching and the implementing regulations still pending, we expect to see a wave of restructuring and corporate actions, particularly from financial groups with foreign ultimate shareholders, as they race to comply with the evolving framework.

By partners Monic Devina (mdevina@abnrlaw.com), Rully Hidayat (rhidayat@abnrlaw.com), associates Arian Hasyim (ahasyim@abnrlaw.com), and Ruth Mendrofa (rmendrofa@abnrlaw.com).

This ABNR News and its contents are intended solely to provide a general overview, for informational purposes, of selected recent developments in Indonesian law. They do not constitute legal advice and should not be relied upon as such. Accordingly, ABNR accepts no liability of any kind in respect of any statement, opinion, view, error, or omission that may be contained in this legal update. In all circumstances, you are strongly advised to consult a licensed Indonesian legal practitioner before taking any action that could adversely affect your rights and obligations under Indonesian law.

More Legal Updates

- 20 Feb 2026 ABNR Lawyers Present at IJM-Hosted Session on Child Protection and Electronic Evidence with Indonesian National Police

- 12 Feb 2026 A rising star shines brightest when supported by a strong foundation.

- 09 Feb 2026 ABNR Shares Insights with OJK on KUHAP 2025 and Its Potential Impact on Criminal Investigation in the Financial Services Sector

- 09 Feb 2026 ABNR Partners Engage with OJK on SOE Law Revisions and Financial Sector Oversight

- 04 Feb 2026 Corporate Actions in Indonesia Face New Scrutiny under MOL Regulation No. 49 of 2025

- 02 Feb 2026 ABNR Advises CBL Group on Strategic Acquisition of PT Tri Jaya Tangguh

NEWS DETAIL

20 Jun 2025

OJK’s Financial Conglomerate Framework: Preparing for the June Deadline

Indonesia has issued a new regulation on financial conglomerates that significantly reshapes how business groups in the financial sector must structure and report their operations. This update is particularly relevant for foreign investors, private banks, and digital finance platforms ahead of the June 2025 compliance deadline.

To implement Law No. 4 of 2023 on the Development and Strengthening of the Financial Sector (“Law 4/2023”), Indonesia’s Financial Services Authority (OJK) issued Regulation No. 30 of 2024 on Financial Conglomerates and Financial Conglomerate Holding Companies (“Regulation”) in December 2024. This Regulation replaces OJK Regulation No. 45/POJK.03/2020 (“OJK Reg. 45/2020”).

The new framework aims to enhance the efficiency and effectiveness of OJK’s supervision over financial services institutions (Lembaga Jasa Keuangan or LJKs) that are interconnected by ownership and/or control within a business group.

What Constitutes a Financial Conglomerate?

Under the Regulation, a financial conglomerate consists of:

a Financial Holding Company (Perusahaan Induk Konglomerasi Keuangan or PIKK), and

LJK members that fall within the same ownership or control group.

The PIKK serves as the controlling and consolidating entity. Its members may include a wide range of LJKs operating under conventional or Sharia principles, such as:

Banks

Insurance companies

Securities companies

Finance companies

Infrastructure finance companies

Guarantor agencies

Pension funds

Venture capital firms

Pawnbrokers

IT-based joint funding platforms

Crowdfunding operators

Other types of LJKs, excluding microfinance institutions.

Compared to OJK Reg. 45/2020, the new Regulation significantly broadens the definition of LJKs that qualify as conglomerate members.

Operational vs Non-Operational PIKK

A financial holding company (PIKK) that also holds a license to operate as a financial institution (LJK) is classified as an operational PIKK. In contrast, a holding company that does not carry out any financial services activities and is used solely as a holding and consolidation vehicle is classified as a non-operational PIKK.

Each PIKK, operational or non-operational, must be controlled directly by a Controlling Shareholder (Pemegang Saham Pengendali or PSP) and/or indirectly by an Ultimate Shareholder (Pemegang Saham Pengendali Terakhir or PSPT).

When Is a PIKK Required?

A PIKK must be established if a financial group’s total assets meet one of the following thresholds:

≥ IDR 100 trillion, with at least two LJKs from different financial sectors; or

IDR 20 trillion to < IDR 100 trillion, with at least three LJKs from different financial sectors.

Note: Asset thresholds are assessed based on the total assets of all LJK members over six consecutive months.

Groups approaching the IDR 20 trillion threshold should assess their current structure early to avoid rushed or reactive compliance.

OJK also retains discretionary authority to require the formation of a PIKK even if these thresholds are not met, where a group’s complexity or systemic relevance warrants it.

Relaxation and Exemption for Financial Conglomerate

The government provides incentives to support the formation of financial holding companies. Under Law Number 4 of 2023, companies that restructure their group by setting up a holding company may be eligible for tax benefits, especially for related asset transfers—provided they follow applicable tax rules.

In addition, the regulation waives key capital market obligations, including the requirement to conduct a mandatory tender offer, for share transfers made solely to comply with the holding company formation.

However, the tax incentives remain inactive pending issuance of implementing rules by the Minister of Finance.

Market Entry Path for Foreign Financial Holding Companies

Indonesia remains an attractive destination for foreign investors—many of whom operate as large, cross-border financial holding companies. However, Indonesia’s regulatory framework imposes clear limits on how these foreign entities can structure their investments.

Under the new regulation, a financial holding company must be incorporated in Indonesia and must receive approval from the Financial Services Authority (OJK). This means a foreign holding company cannot directly act as the central holding company (PIKK) to consolidate its local group members.

Instead, foreign investors must take an indirect control approach—by acting as the controlling shareholder (either directly or ultimately) of a locally incorporated PIKK. This PIKK then holds and manages the group’s financial services subsidiaries in Indonesia.

It is also important to note that full foreign ownership of a PIKK is not permitted. A minimum level of Indonesian ownership is required, reinforcing the regulator’s policy to maintain local control at the top of the structure.

|

Illustration of a Financial Conglomerate Organization |

Foreign Ownership Limits: Operational vs Non-Operational Holding Companies

For operational holding companies—those licensed to conduct financial activities—the level of permitted foreign ownership is subject to sector-specific limits. For example:

Up to 85% foreign ownership is allowed in finance companies

Up to 80% for privately owned insurance companies

In some cases, these limits must be calculated on a cumulative basis, taking into account both direct and indirect ownership all the way up to the ultimate shareholder. This layered approach affects not only the holding company but also its subsidiaries within the group.

Key Operational Challenges for Foreign Holding Companies

Foreign investors that set up an operational financial holding company in Indonesia face several practical hurdles—particularly in complying with financial reporting and investment restrictions.

One major challenge is the requirement to consolidate financial statements. If the holding company is operational (for example, a licensed bank), it must combine its financial reports with those of its subsidiaries. This often becomes complicated when the group includes diverse businesses (e.g., insurance, financing, securities), each potentially governed by a different direct controlling shareholder, despite having the same ultimate shareholder. This may conflict with home-jurisdiction accounting standards and complicate group-level reporting.

A second challenge is that operational holding companies (PIKK) must also navigate sector-specific restrictions, which often conflict with the Regulation’s consolidation requirements—especially for foreign-controlled groups. For example, if a peer-to-peer (P2P) lending company is designated as the holding company, it faces two key limits:

A cap of 20% of total equity for all direct investments; and

A stricter 10% cap for investments in affiliated entities within the same group.

These caps may hinder effective group control and require alternative structuring strategies, especially for conglomerates seeking to consolidate via direct equity participation.

Indonesia’s Financial Conglomerates: State-Owned Dominance and Digital Momentum

Indonesia’s financial conglomerate landscape remains heavily dominated by state-owned banks, which hold the largest market share. Notably, these state-controlled institutions are exempt from several key provisions under the new regulation, placing the regulatory burden primarily on privately owned banks.

These private institutions often serve as financial holding companies, overseeing a diverse range of subsidiaries across financing, insurance, and capital markets. A notable trend is the growing integration of digital banks into these conglomerate structures, reflecting a broader shift toward digital transformation within Indonesia’s financial sector. The inclusion of IT-based platforms and crowdfunding operators in the definition of LJKs reflects OJK’s recognition of digital banking as a key player in future financial conglomerates.

Despite changes in the regulatory landscape, reporting obligations under OJK Regulation No. 18/POJK.03/2014—on integrated governance for financial conglomerates—remain in force. Although partially revoked by the previous regulation, it has not been repealed by the current framework. As such, newly established holding companies must still publish integrated governance reports on their official websites. These disclosures offer prospective investors valuable visibility into the group’s structure and governance practices.

Conclusion

Indonesia’s regulatory framework for financial conglomerates remains complex and strongly protectionist. This is reflected in both quantitative restrictions (such as ownership limits) and qualitative measures (such as structural control requirements), which pose significant barriers for foreign investors entering or expanding in the market.

Although the criteria for establishing a financial holding company (PIKK) are clearly defined, the Financial Services Authority (OJK) retains discretionary power to require the formation of a PIKK based on the group’s complexity or its potential impact on financial system stability.

With the 23 June 2025 submission deadline approaching and the implementing regulations still pending, we expect to see a wave of restructuring and corporate actions, particularly from financial groups with foreign ultimate shareholders, as they race to comply with the evolving framework.

By partners Monic Devina (mdevina@abnrlaw.com), Rully Hidayat (rhidayat@abnrlaw.com), associates Arian Hasyim (ahasyim@abnrlaw.com), and Ruth Mendrofa (rmendrofa@abnrlaw.com).

This ABNR News and its contents are intended solely to provide a general overview, for informational purposes, of selected recent developments in Indonesian law. They do not constitute legal advice and should not be relied upon as such. Accordingly, ABNR accepts no liability of any kind in respect of any statement, opinion, view, error, or omission that may be contained in this legal update. In all circumstances, you are strongly advised to consult a licensed Indonesian legal practitioner before taking any action that could adversely affect your rights and obligations under Indonesian law.