Turning Waste into Tomorrow’s Green Energy: PR 109/2025 and Its Impact on Waste Management Policy

The Government of Indonesia issued Presidential Regulation (“PR”) No. 109 of 2025 on Urban Waste Management through Waste-to-Renewable Energy Processing Based on Environmentally Friendly Technology (“PR 109/2025”). The regulation came into force on 10 October 2025 and revokes PR No. 35 of 2018 on the Acceleration of the Development of Waste-to-Energy (“WtE”) Installations Based on Environmentally Friendly Technology (“PR 35/2018”).

The issuance of PR 109/2025 was driven by the urgent need to address Indonesia’s escalating urban waste crisis, as waste generation in 2023 reached 56.63 million tons with the majority remaining unmanaged, leading to severe environmental pollution and public health risks. Based on the consideration of PR 1092025, the previous regulation, PR 35/2018, was found to be unsuccessful in accelerating WtE projects and only few WtE projects have been tendered and developed to address the urban waste crisis.

Against this background, PR 109/2025 adopts a broader and more integrated approach. Rather than focusing on converting WtE facilities, the regulation allows waste to be processed into various forms of renewable energy, including bioenergy and renewable fuels, using environmentally friendly technologies. This shift aims to support national energy resilience and introduces the “polluter pays” principle, ensuring that all parties are held responsible for the waste they generate.

The key provisions of PR 109/2025 are as follows:

Project Location and Eligibility

Under PR 35/2018, the acceleration of WtE plant development was limited to 12 designated cities. PR 109/2025 significantly expands this mandate by permitting any city or district to develop WtE projects, subject to eligibility requirements.

To participate, the relevant local government must submit a formal statement letter to the Ministry of Environment (“MOE”) confirming that it:

guarantees a continuous waste supply of at least 1,000 tons per day throughout the operational period of the WtE facility t;

allocates funding for waste management from the regional budget (APBD) funds;

provides land for the project under a loan-for-use arrangement, free of charge during both construction and operation phases;

commits to issuing regional regulations governing service fees;

integrates the WtE project into regional development plan and waste management master plans; and

conducts public consultations with communities situated near the project site.

By adopting this wider framework, PR 109/2025 allows for more regions across the country to develop and benefit from WtE initiatives.

WtE Plants Project Developer Procurement

(a) SOE Investment Cooperation

Under PR 35/2018, regional governments could appoint regional-owned enterprises (“ROEs”) or conduct open tenders to select WtE project developers. Where no private developer was interested or qualified, and no ROE was capable of undertaking the project, state-owned enterprises (SOEs) could be assigned to develop and operate WtE plants.

In contrast, PR 109/2025 shifts project procurement to a more centralized model. Project development is led through BPI Danantara (the state investment agency), acting via its investment holding company, SOEs, and their subsidiaries. Project developers are selected based on the following minimum qualifications:

possession of proven, up-to-date, and environmentally friendly WtE technology suitable to process the relevant waste characteristics;

sufficient financial capacity and ability to meet investment commitments; and

prior experience in WtE plant development in compliance with applicable standards and regulations.

PR 109/2025 authorizes BPI Danantara to make direct appointments of developers in specific urgent or exceptional circumstances, including where:

only one candidate meets the eligibility requirements;

the project site is designated as a waste emergency area by the MOE; and/or

a developer had been appointed (by regional government) prior to the issuance of PR 109/2025, but such appointment was subsequently terminated in a final and binding manner.

The selection and implementation of project developers are subject to the prevailing rules on investment cooperation involving SOEs and/or their subsidiaries.

(b) Public Private Partnership (PPP) Cooperation

Previously under PR 35/2018 regime, if (i) no participants register; or (ii) none of the participants meet the required criteria, the Ministry of Energy and Mineral Resources (“MEMR”) based on the proposal from the governor or mayor will appoint the developer.

Currently under PR 109/2025, if situations (i) and (ii) occur then the SOE and/or its subsidiary, through BPI Danantara, must submit a report on the selection results to the following ministries:

the Coordinating Ministry for Maritime Affairs and Investment;

the MOE;

MEMR; and

the Ministry of Home Affairs.

Based on this report, the Coordinating Ministry for Maritime Affairs and Investment will organize a coordination meeting involving the relevant local governments to encourage collaboration between regional governments and private business entities interested in developing the WtE project.

This cooperation between local governments and business entities proceeds through the following stages:

The interested business entity submits a letter of investment interest to the MEMR;

The MEMR forwards the investment interest to the relevant provincial and/or district/city government for potential collaboration in developing the WtE project; and

The cooperation agreement between the local government and the business entity is formalized through a notarial deed.

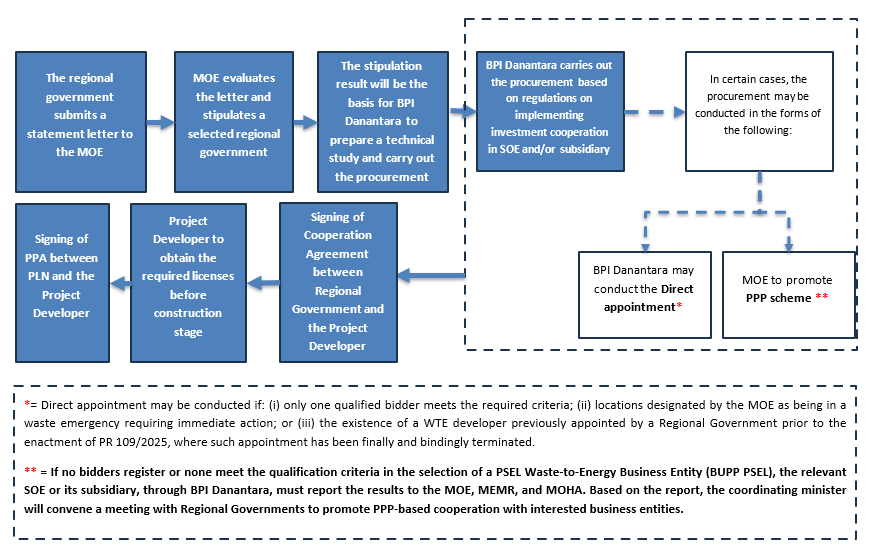

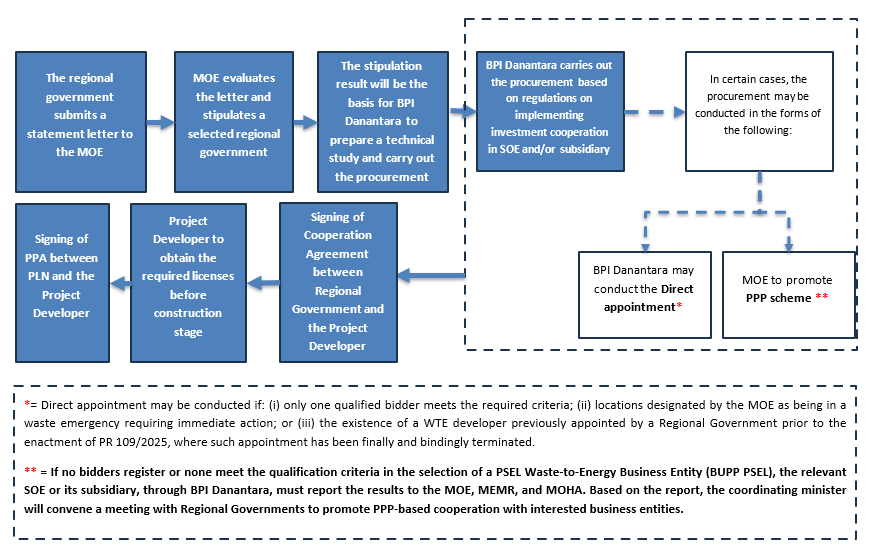

Please refer to the chart at the end of this newsletter for better understanding on WtE Plants Project Developer Procurement under PR 109/2025.

Electricity Purchase Price and Power Purchase Agreement (PPA)

PR 109/2025 introduces material changes among others in respect of the electricity purchase price and key terms of the power purchase framework for WtE projects, including the applicable tariff, PPA duration, PLN’s role, dispatch arrangements, and the timeline for PPA execution. These changes are set out below.

WtE Feed-in Tariff

PR 109/2025 replaces the tiered pricing regime under PR 35/2018 with a single flat tariff. Electricity generated from WtE projects is now subject to a fixed purchase price of USD 0.20/kWh, regardless the plant capacity. The tariff is non-negotiable and does not include escalation, although it may be reviewed by the MEMR in special circumstances.

PPA Duration

PPA duration is also shortened from 35 years to 30 years, starting from the commercial operation date, reflecting a push for faster project cycles.

PLN Assignment

Previously under PR 35/2018, PLN's involvement was subject to proposal by regional governments, while under PR 109/2025, PLN is expressly mandated to directly purchase electricity from WtE Projects procured based on PR 109/2025.

Dispatch Priority and Penalty for Shortfall

PR 109/2025 further guarantees priority dispatch for electricity from WtE plants into PLN’s grid and exempts developers from penalties for shortfalls caused by technical issues beyond their control or insufficient waste supply, which was not addressed in the PR 35/2018.

PPA Execution Timeline

PLN is now required to sign the PPA within 10 working days after all permits are secured—a significant acceleration compared to the 35 working days stipulated in the PR 35/2018—demonstrating the government’s urgency in addressing Indonesia’s waste management challenges.

Permitting and Approvals

Permitting under PR 35/2018 requires environmental and electricity sector approvals, with the process involving multiple authorities and coordination with the central government. PR 109/2025 streamlines this process by mandating that all permits be processed through the OSS (Online Single Submission) system. Environmental approvals are now subject to a two-month statutory timeline. If no decision is made within this two-month period, the approval is deemed granted, reducing bureaucratic delays which are typically seen in environmental approvals process.

Incentives and Subsidies

PR 35/2018 allowed for central government subsidies of up to Rp500,000 per ton of waste processed. The subsidies are no longer applicable as PR 109/2025 regulation shifts the focus to providing tax and fiscal incentives for the use of domestic technology, and explicitly states that after the cooperation period ends, regional governments must operate WtE projects without central government subsidies.

Other Products Derived from Waste

While PR 35/2018 emphasizes the use of environmentally friendly and proven technology for WtE plants, PR 109/2025 expands the technological focus. It now includes not only WtE plants but also bioenergy, renewable fuels, and other innovative products derived from waste, encouraging the adoption of the latest and most suitable technologies for different types of waste. PR 109/2025 however does not provide extensive regulatory points on this new technological focus as further implementing regulations are expected to be issued soon by the MEMR.

ABNR Commentary

The issuance of PR 109/2025 marks a significant shift in Indonesia’s waste management policy, reflecting a move toward a more integrated and sustainable framework. By expanding WtE to include bioenergy and renewable fuels, the regulation aligns waste management with national energy resilience objectives. Key reforms—such as centralized procurement through BPI Danantara, streamlined permitting via the OSS system, and faster PPA execution—address structural bottlenecks under PR 35/2018.

As of this newsletter’s issuance, BPI Danantara plans to commence construction of seven WtE facilities in early 2026 as the first phase of the national WtE program. Tenders already begun in November 2025, with awards expected in Q1 2026 and groundbreaking targeted for March–April. The first phase targets cities deemed ready for WtE facilities include Bogor, Denpasar, Yogyakarta, Semarang, and Bekasi.

Taken together, these regulatory reforms are expected to accelerate private sector participation and expedite the development of waste-to-energy projects across Indonesia. Stakeholders, particularly prospective investors, should carefully assess the implications of the new aforementioned provisions especially the transition to centralized procurement. A thorough evaluation of project bankability, risk allocation, and compliance with updated selection criteria will be critical to navigating this revised landscape.

By partners Emir Nurmansyah (enurmansyah@abnrlaw.com), Serafina Muryanti (smuryanti@abnrlaw.com), Maher Sasongko (msasongko@abnrlaw.com), and associates Adya Sepasthika (asepasthika@abnrlaw.com) and Muhammad Irsan (mirsan@abnrlaw.com).

This ABNR News and its contents are intended solely to provide a general overview, for informational purposes, of selected recent developments in Indonesian law. They do not constitute legal advice and should not be relied upon as such. Accordingly, ABNR accepts no liability of any kind in respect of any statement, opinion, view, error, or omission that may be contained in this legal update. In all circumstances, you are strongly advised to consult a licensed Indonesian legal practitioner before taking any action that could adversely affect your rights and obligations under Indonesian law.

More Legal Updates

- 09 Mar 2026 Preparing for POJK 30/2025: OJK's New Governance and Risk Management Requirements for ITSK Organizers

- 04 Mar 2026 OJK Reg. 33/2025: OJK Expands and Strengthens Soundness Level Assessments Framework for Insurance Companies, Guarantee Institutions, and Pension Funds

- 27 Feb 2026 Strengthening the PPP Ecosystem: Key Enhancements under Bappenas Reg 9/2025

- 27 Feb 2026 Seven ABNR Partners Named to The 200 Club: Indonesia's Most Influential Lawyers 2026

- 20 Feb 2026 ABNR Lawyers Present at IJM-Hosted Session on Child Protection and Electronic Evidence with Indonesian National Police

- 12 Feb 2026 A rising star shines brightest when supported by a strong foundation.

NEWS DETAIL

23 Jan 2026

Turning Waste into Tomorrow’s Green Energy: PR 109/2025 and Its Impact on Waste Management Policy

The Government of Indonesia issued Presidential Regulation (“PR”) No. 109 of 2025 on Urban Waste Management through Waste-to-Renewable Energy Processing Based on Environmentally Friendly Technology (“PR 109/2025”). The regulation came into force on 10 October 2025 and revokes PR No. 35 of 2018 on the Acceleration of the Development of Waste-to-Energy (“WtE”) Installations Based on Environmentally Friendly Technology (“PR 35/2018”).

The issuance of PR 109/2025 was driven by the urgent need to address Indonesia’s escalating urban waste crisis, as waste generation in 2023 reached 56.63 million tons with the majority remaining unmanaged, leading to severe environmental pollution and public health risks. Based on the consideration of PR 1092025, the previous regulation, PR 35/2018, was found to be unsuccessful in accelerating WtE projects and only few WtE projects have been tendered and developed to address the urban waste crisis.

Against this background, PR 109/2025 adopts a broader and more integrated approach. Rather than focusing on converting WtE facilities, the regulation allows waste to be processed into various forms of renewable energy, including bioenergy and renewable fuels, using environmentally friendly technologies. This shift aims to support national energy resilience and introduces the “polluter pays” principle, ensuring that all parties are held responsible for the waste they generate.

The key provisions of PR 109/2025 are as follows:

Project Location and Eligibility

Under PR 35/2018, the acceleration of WtE plant development was limited to 12 designated cities. PR 109/2025 significantly expands this mandate by permitting any city or district to develop WtE projects, subject to eligibility requirements.

To participate, the relevant local government must submit a formal statement letter to the Ministry of Environment (“MOE”) confirming that it:

guarantees a continuous waste supply of at least 1,000 tons per day throughout the operational period of the WtE facility t;

allocates funding for waste management from the regional budget (APBD) funds;

provides land for the project under a loan-for-use arrangement, free of charge during both construction and operation phases;

commits to issuing regional regulations governing service fees;

integrates the WtE project into regional development plan and waste management master plans; and

conducts public consultations with communities situated near the project site.

By adopting this wider framework, PR 109/2025 allows for more regions across the country to develop and benefit from WtE initiatives.

WtE Plants Project Developer Procurement

(a) SOE Investment Cooperation

Under PR 35/2018, regional governments could appoint regional-owned enterprises (“ROEs”) or conduct open tenders to select WtE project developers. Where no private developer was interested or qualified, and no ROE was capable of undertaking the project, state-owned enterprises (SOEs) could be assigned to develop and operate WtE plants.

In contrast, PR 109/2025 shifts project procurement to a more centralized model. Project development is led through BPI Danantara (the state investment agency), acting via its investment holding company, SOEs, and their subsidiaries. Project developers are selected based on the following minimum qualifications:

possession of proven, up-to-date, and environmentally friendly WtE technology suitable to process the relevant waste characteristics;

sufficient financial capacity and ability to meet investment commitments; and

prior experience in WtE plant development in compliance with applicable standards and regulations.

PR 109/2025 authorizes BPI Danantara to make direct appointments of developers in specific urgent or exceptional circumstances, including where:

only one candidate meets the eligibility requirements;

the project site is designated as a waste emergency area by the MOE; and/or

a developer had been appointed (by regional government) prior to the issuance of PR 109/2025, but such appointment was subsequently terminated in a final and binding manner.

The selection and implementation of project developers are subject to the prevailing rules on investment cooperation involving SOEs and/or their subsidiaries.

(b) Public Private Partnership (PPP) Cooperation

Previously under PR 35/2018 regime, if (i) no participants register; or (ii) none of the participants meet the required criteria, the Ministry of Energy and Mineral Resources (“MEMR”) based on the proposal from the governor or mayor will appoint the developer.

Currently under PR 109/2025, if situations (i) and (ii) occur then the SOE and/or its subsidiary, through BPI Danantara, must submit a report on the selection results to the following ministries:

the Coordinating Ministry for Maritime Affairs and Investment;

the MOE;

MEMR; and

the Ministry of Home Affairs.

Based on this report, the Coordinating Ministry for Maritime Affairs and Investment will organize a coordination meeting involving the relevant local governments to encourage collaboration between regional governments and private business entities interested in developing the WtE project.

This cooperation between local governments and business entities proceeds through the following stages:

The interested business entity submits a letter of investment interest to the MEMR;

The MEMR forwards the investment interest to the relevant provincial and/or district/city government for potential collaboration in developing the WtE project; and

The cooperation agreement between the local government and the business entity is formalized through a notarial deed.

Please refer to the chart at the end of this newsletter for better understanding on WtE Plants Project Developer Procurement under PR 109/2025.

Electricity Purchase Price and Power Purchase Agreement (PPA)

PR 109/2025 introduces material changes among others in respect of the electricity purchase price and key terms of the power purchase framework for WtE projects, including the applicable tariff, PPA duration, PLN’s role, dispatch arrangements, and the timeline for PPA execution. These changes are set out below.

WtE Feed-in Tariff

PR 109/2025 replaces the tiered pricing regime under PR 35/2018 with a single flat tariff. Electricity generated from WtE projects is now subject to a fixed purchase price of USD 0.20/kWh, regardless the plant capacity. The tariff is non-negotiable and does not include escalation, although it may be reviewed by the MEMR in special circumstances.

PPA Duration

PPA duration is also shortened from 35 years to 30 years, starting from the commercial operation date, reflecting a push for faster project cycles.

PLN Assignment

Previously under PR 35/2018, PLN's involvement was subject to proposal by regional governments, while under PR 109/2025, PLN is expressly mandated to directly purchase electricity from WtE Projects procured based on PR 109/2025.

Dispatch Priority and Penalty for Shortfall

PR 109/2025 further guarantees priority dispatch for electricity from WtE plants into PLN’s grid and exempts developers from penalties for shortfalls caused by technical issues beyond their control or insufficient waste supply, which was not addressed in the PR 35/2018.

PPA Execution Timeline

PLN is now required to sign the PPA within 10 working days after all permits are secured—a significant acceleration compared to the 35 working days stipulated in the PR 35/2018—demonstrating the government’s urgency in addressing Indonesia’s waste management challenges.

Permitting and Approvals

Permitting under PR 35/2018 requires environmental and electricity sector approvals, with the process involving multiple authorities and coordination with the central government. PR 109/2025 streamlines this process by mandating that all permits be processed through the OSS (Online Single Submission) system. Environmental approvals are now subject to a two-month statutory timeline. If no decision is made within this two-month period, the approval is deemed granted, reducing bureaucratic delays which are typically seen in environmental approvals process.

Incentives and Subsidies

PR 35/2018 allowed for central government subsidies of up to Rp500,000 per ton of waste processed. The subsidies are no longer applicable as PR 109/2025 regulation shifts the focus to providing tax and fiscal incentives for the use of domestic technology, and explicitly states that after the cooperation period ends, regional governments must operate WtE projects without central government subsidies.

Other Products Derived from Waste

While PR 35/2018 emphasizes the use of environmentally friendly and proven technology for WtE plants, PR 109/2025 expands the technological focus. It now includes not only WtE plants but also bioenergy, renewable fuels, and other innovative products derived from waste, encouraging the adoption of the latest and most suitable technologies for different types of waste. PR 109/2025 however does not provide extensive regulatory points on this new technological focus as further implementing regulations are expected to be issued soon by the MEMR.

ABNR Commentary

The issuance of PR 109/2025 marks a significant shift in Indonesia’s waste management policy, reflecting a move toward a more integrated and sustainable framework. By expanding WtE to include bioenergy and renewable fuels, the regulation aligns waste management with national energy resilience objectives. Key reforms—such as centralized procurement through BPI Danantara, streamlined permitting via the OSS system, and faster PPA execution—address structural bottlenecks under PR 35/2018.

As of this newsletter’s issuance, BPI Danantara plans to commence construction of seven WtE facilities in early 2026 as the first phase of the national WtE program. Tenders already begun in November 2025, with awards expected in Q1 2026 and groundbreaking targeted for March–April. The first phase targets cities deemed ready for WtE facilities include Bogor, Denpasar, Yogyakarta, Semarang, and Bekasi.

Taken together, these regulatory reforms are expected to accelerate private sector participation and expedite the development of waste-to-energy projects across Indonesia. Stakeholders, particularly prospective investors, should carefully assess the implications of the new aforementioned provisions especially the transition to centralized procurement. A thorough evaluation of project bankability, risk allocation, and compliance with updated selection criteria will be critical to navigating this revised landscape.

By partners Emir Nurmansyah (enurmansyah@abnrlaw.com), Serafina Muryanti (smuryanti@abnrlaw.com), Maher Sasongko (msasongko@abnrlaw.com), and associates Adya Sepasthika (asepasthika@abnrlaw.com) and Muhammad Irsan (mirsan@abnrlaw.com).

This ABNR News and its contents are intended solely to provide a general overview, for informational purposes, of selected recent developments in Indonesian law. They do not constitute legal advice and should not be relied upon as such. Accordingly, ABNR accepts no liability of any kind in respect of any statement, opinion, view, error, or omission that may be contained in this legal update. In all circumstances, you are strongly advised to consult a licensed Indonesian legal practitioner before taking any action that could adversely affect your rights and obligations under Indonesian law.